Creating a Peer to Peer Blockchain Hood Incident Coverage Platform

In a hood somewhere in America, a 28-year-old brotha still living in his momma attic is on the Interweb talking tough like he on these streets and lying about making money in cryptocurrency. Before he put on a video game, his momma yell into the attic she need him to run to the corner store and get some sweet potatoes. The brotha get nervous.

That keyboard-gangsta brotha is really scared of those real streets and know as soon as he gets around the corner, those corner boys don’t know him and may challenge him or mistake him as a hostile. But his mom told him to go get some sweet potatoes and he got to do what his momma tell him to do. The brotha decided he got to take a risk going to the corner store and he is going to go online and get a blockchain-based incident coverage that would pay him a fixed fee if he was harmed in the process of walking to the corner store.

Blockchain-based risk sharing is a new paradigm of peer-to-peer risk sharing and is different from existing platforms such as Lemonade and Friendsurance. While other peer-to-peer risk sharing platforms are pooled premiums to pay off claims like traditional insurance models, blockchain-based risk sharing is a pure one-to-one risk modeling where one person acts individually as an insurer for an insured policy. In this model, there is no “premium pool” or risk of insolvency – the policy benefit and the premium will be stored in a trust account. The just-in-time factor shift the risk to the individual acting as an insurer.

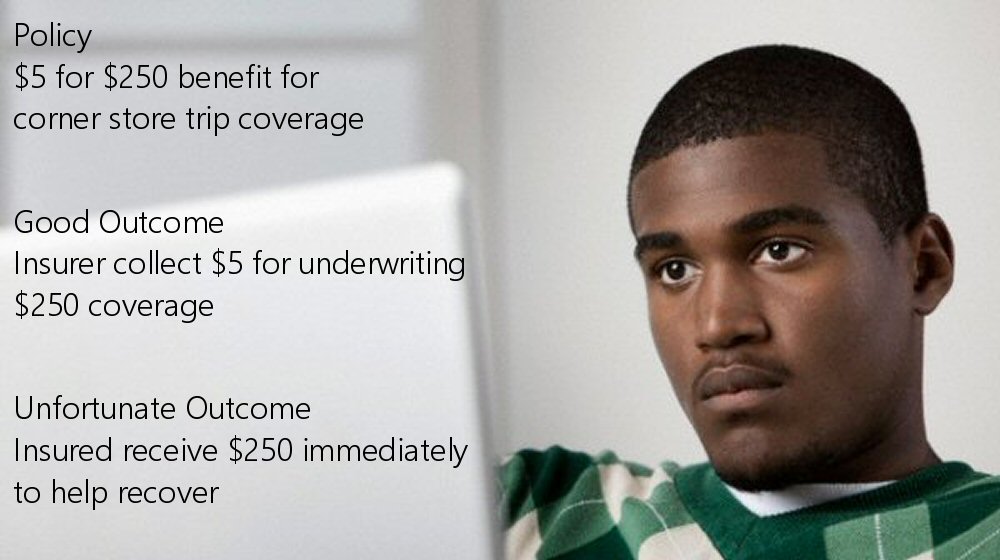

To let’s do a walkthrough with the lame brotha still living in his momma attic. A family that want the hood to be safe for brothas and sistas has put $250 into the system. When the lame brotha pay $5 to request a policy for a $250 cash benefit to cover his ObamaCare deductible if something happen to him, the request goes to the exchange and a matching bot pulls the $250 from the family account and inform the family they will be providing coverage for that lame brotha grocery store trip.

The lame brotha proceed to the grocery store around the corner and immediately get a beat down because one of the corner boys recognized him from a livestream talking some smack. The $250 is paid to the brotha so he can cover his initial fees at the medical center. Someone recognizes him at the hospital all bruised up, take a picture and upload it to social media and everybody online laughing and commenting how he got his ass whooped.

Now if the lame brotha successfully went around the corner and did not have any incident, the $5 premium paid is transferred to the family who just earned $5 off their $250 unused benefit. So as long as more hood people keep putting policies out on the family $250 cash, they get $5 back if nothing happens. If something happens, the family basically helped someone in the hood cover their ObamaCare deductible and can feel good about that as well. It can be a case where the same $250 does 5-7 policy coverage a day returning $25 to $35 a day in revenue from the $250 the family put in to help provide coverage.

This kind of platform has a very good benefit for the hood and if claims had to be paid out, we would know the claim details of where there are problems at in the hood and work to improve those areas to reduce the number of claims and benefit paid out. We would have just as much valuable data as the police to know what is happening in the hood and have a financial incentive to make the hood better.

In this example, if the corner boys are causing independent insurers to keep paying out premiums, then those corner boys are messing with people money and those corner boys going to have to dealt with because they a problem. Corners boys are just fish in a barrel because they can’t just walk to someone else corner and no one want their corner if it is hot, so that will be straightforward to take care of.

The DBEXX blockchain exchange platform and Fooky API can definitely establish this platform and facilitate the policies, digital signature and rules for payout and claim processing.

Kossier will be used for accounts and will use the upgraded version where Kossier accounts are verified to a real person.

Fooky APIs will be used to manage platform authentication, the account ledgers and the natural language blockchain.

DBEXX exchange will be customized to allow the order matching quickly match claim history, proposed policies, level of risk and available funds to general just-in-time covered policies.

While the platform can be created right now, keep in mind there are a few considerations with this model.

First, there need to be a risk assessment so if a person filed a claim before or live in a really bad spot, they may have to pay a higher premium like $10-$15 and independent insurers may want to take a bigger risk for bigger payout or may say just focus on the insuring the less risk – the platform will tell the high risk no one is willing to insure them, that’s all.

Second, we need to look at regulation and compliance and so far, it looks like this model is okay but we still checking and will update when possible. We looked at the auto rental business and they use phrase like coverage and reimbursement but do not use the word “insurance” and we peeped that during our research.

One more note, keep in mind anybody in the world can be insurers for the hood and provide a level of relief and coverage against problems especially for those who cannot afford insurance coverage. At most, a modest benefit to cover primary insurance deductible or provide immediate funds to help recover immediately after an incident is the best use case. The black community could really benefit by establishing a risk platform that not only allow brothas and sistas in the hood have access to risk recovery but it can help us better the black community altogether by identifying those risk and having a true financial incentive for people to deal with reducing risk in the hood.